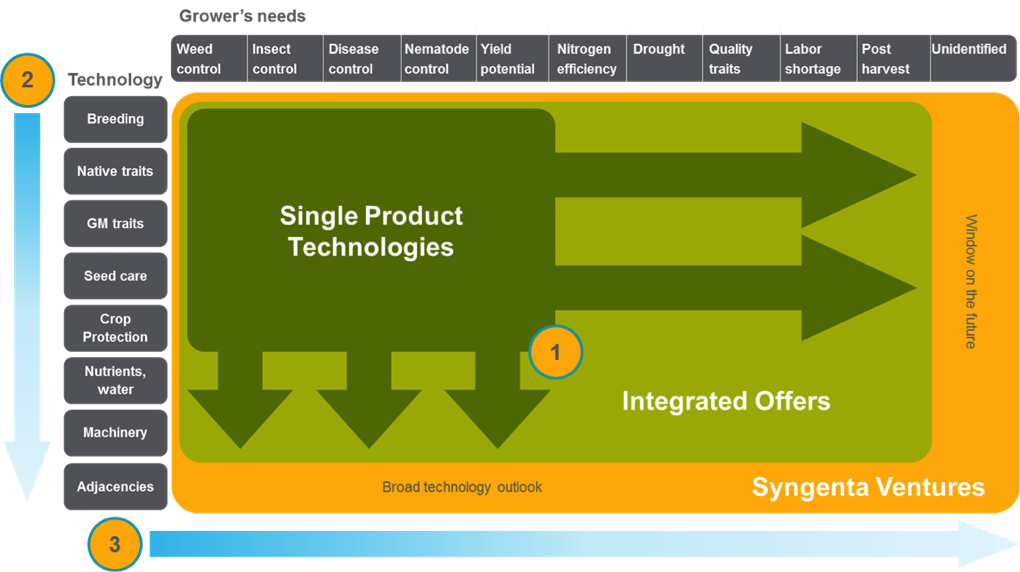

We have a broad investment scope that supports Syngenta’s core activities of producing and selling agricultural crop protection products and seeds.

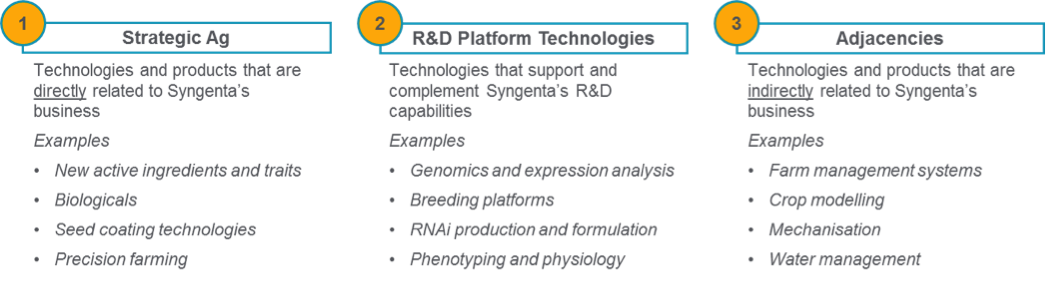

We categorize our investment activities into three distinct categories, as shown by the graphic below. The first category, Strategic Ag, focuses on Syngenta’s core business by investing in technologies and companies that are directly relevant to Syngenta’s business. We often invest in early stage companies in this segment as we are well positioned to assess the technologies and can bring additional value by accelerating their path to commercialization.

The second investment category is R&D Platform Technologies. The companies in this segment typically have a broad technology capability that can be applied to a number of different industries. Our investment will often support the expansion of this technology into agriculture, creating additional value for the portfolio company.

The third category is Adjacencies, which recognizes the important role that venture capital can play in identifying potentially disruptive technologies. Our investments in this segment are often in very different industries to Syngenta, but they all share the common theme of having technologies or business models that have the potential to shape the future of agriculture.